Getting The Feie Calculator To Work

Table of Contents5 Simple Techniques For Feie CalculatorGetting The Feie Calculator To WorkGet This Report about Feie CalculatorThe smart Trick of Feie Calculator That Nobody is Talking AboutThe Ultimate Guide To Feie Calculator

US deportees aren't restricted only to expat-specific tax obligation breaks. Commonly, they can declare a number of the very same tax credits and deductions as they would certainly in the US, including the Youngster Tax Obligation Credit Score (CTC) and the Lifetime Discovering Debt (LLC). It's feasible for the FEIE to reduce your AGI a lot that you don't get certain tax credit scores, however, so you'll need to confirm your eligibility.

The tax code states that if you're a united state person or a resident alien of the United States and you live abroad, the internal revenue service taxes your around the world revenue. You make it, they tax it regardless of where you make it. However you do obtain a wonderful exemption for tax obligation year 2024.

For 2024, the optimal exclusion has been enhanced to $126,500. There is additionally a quantity of competent housing costs eligible for exemption. Usually, the maximum amount of real estate costs is restricted to $37,950 for 2024. For such computation, you require to establish your base real estate quantity (line 32 of Kind 2555 (https://www.edocr.com/v/baoqoy8v/feiecalcu/feie-calculator)) which is $55.30 each day ($20,240 annually) for 2024, multiplied by the variety of days in your certifying period that drop within your tax year.

Feie Calculator Things To Know Before You Get This

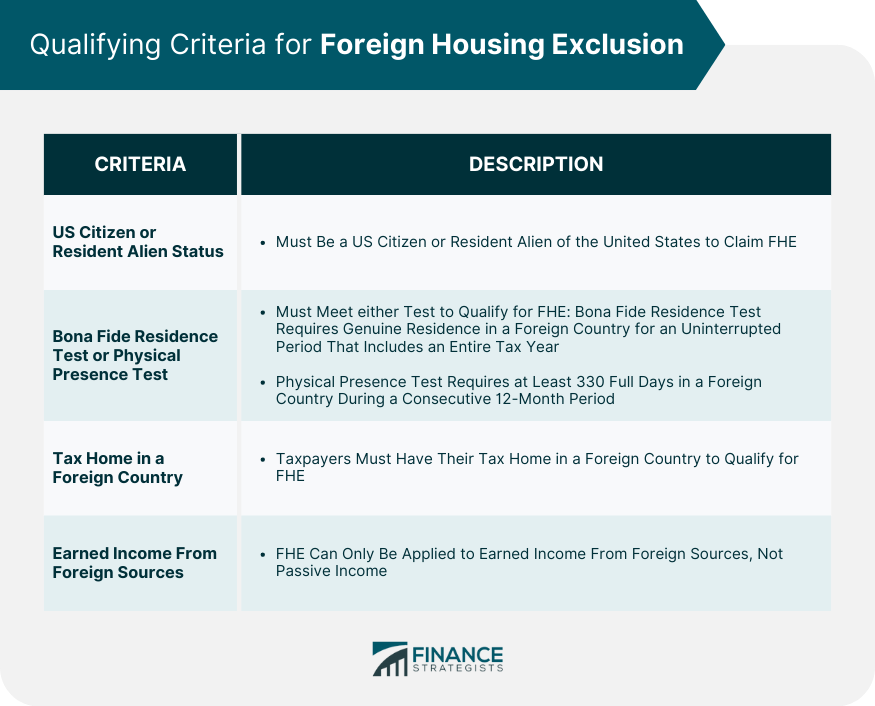

You'll need to figure the exclusion first, because it's restricted to your foreign made income minus any type of foreign real estate exclusion you claim. To certify for the international made earnings exemption, the foreign housing exemption or the foreign housing reduction, your tax obligation home need to remain in an international country, and you should be just one of the following: A bona fide resident of an international country for an undisturbed period that consists of an entire tax obligation year (Authentic Citizen Test).

for at the very least 330 full days during any type of duration of 12 successive months (Physical Visibility Examination). The Authentic Resident Examination is not appropriate to nonresident aliens. If you state to the foreign government that you are not a local, the test is not satisfied. Eligibility for the exemption might also be affected by some tax treaties.

For U.S. people living abroad or earning income from foreign sources, questions commonly occur on just how the united state tax obligation system relates to them and just how they can make sure conformity while reducing tax responsibility. From recognizing what foreign earnings is to navigating different tax return and deductions, it is essential for accounting professionals to comprehend the ins and outs of U.S.

Dive to International revenue is defined as any kind of earnings gained from resources outside of the United States. It incorporates a variety of economic activities, consisting of however not restricted to: Incomes and incomes made while functioning abroad Benefits, allocations, and advantages provided by foreign employers Self-employment income originated from international services Interest earned from international checking account or bonds Dividends from international firms Resources gains from the sale of international assets, such as actual estate or stocks Profits from renting out foreign buildings Revenue generated by foreign organizations or collaborations in which you have an interest Any type of various other revenue earned from foreign resources, such as royalties, spousal support, or betting jackpots International earned earnings is view publisher site defined as income earned with labor or solutions while living and operating in an international nation.

It's important to differentiate foreign made earnings from other sorts of foreign revenue, as the Foreign Earned Income Exclusion (FEIE), a valuable U.S. tax advantage, specifically relates to this category. Investment earnings, rental income, and passive revenue from foreign sources do not certify for the FEIE - American Expats. These kinds of income might undergo various tax obligation treatment

resident alien who is a citizen or nationwide of a country with which the United States has an income tax treaty basically and that is a bona fide homeowner of an international country or nations for an undisturbed duration that consists of a whole tax year, or A united state person or an U.S.

Fascination About Feie Calculator

Foreign made revenue. You must have earned earnings from employment or self-employment in a foreign nation. Passive revenue, such as rate of interest, dividends, and rental revenue, does not qualify for the FEIE. Tax obligation home. You should have a tax home in an international country. Your tax home is normally the place where you perform your normal business tasks and maintain your key financial passions.

This credit history can offset your U.S. tax liability on foreign earnings that is not qualified for the FEIE, such as investment earnings or passive revenue. If you do, you'll then submit added tax kinds (Type 2555 for the FEIE and Form 1116 for the FTC) and affix them to Form 1040.

Some Known Factual Statements About Feie Calculator

The Foreign Earned Income Exemption (FEIE) permits eligible individuals to exclude a part of their international made income from united state tax. This exclusion can dramatically minimize or get rid of the united state tax obligation on international revenue. However, the certain amount of foreign revenue that is tax-free in the united state under the FEIE can alter every year because of rising cost of living changes.